The role of Financial Inclusion (FI) in attaining sustainable development goals has been critical and instrumental, especially in alleviating poverty, promoting gender equity, ensuring food security, and providing access to essential health & hygiene services. The level of inclusion in the formal financial system can be measured through available infrastructural support like bank branches, business correspondents, and ATMs, besides the usage indicators like savings bank accounts, access to credit, enrolments under government-sponsored schemes, along with ease and frequency of making financial transactions or accessing financial services. Examining the underlying infrastructural landscape for FI can help shed light on the challenges and opportunities in the path towards greater inclusion of the unserved and underserved population through the formal financial system.

Aspirational District Program and Financial Inclusion Infrastructure

In January 2018, the Government of India launched the Aspirational District Program (ADP). Under ADP, 117 districts (referred to as Aspirational Districts) were identified with the goal of rapid development and transformation in five key thematic areas, of which Financial Inclusion is an integral component. Examining the infrastructural capabilities of villages within the aspirational districts makes it possible to account for the area-specific strengths and weaknesses.

Six indicators are selected as proxies for evaluating the availability of basic infrastructural capabilities for access to formal financial services. Each indicator captures the percentage of surveyed villages within each district with access to a specific service. These indicators can be broadly classified as physical and digital finance infrastructure. The infrastructure for physical finance captures the necessary foundations for providing in-person access to financial institutions and their services. These indicators include the availability of post offices and sub-post offices, banks, and ATMs. In contrast, the infrastructure for digital finance captures the area’s capability to capitalise on technological and financial innovations for remotely availing formal financial products. The three selected indicators are the availability of internet facilities, mobile services, internet-equipped business correspondents (IBCs), retail agents acting as a bridge between financial institutions and people.

Analysis of Infrastructural Capabilities for Financial Inclusion in Aspirational Districts

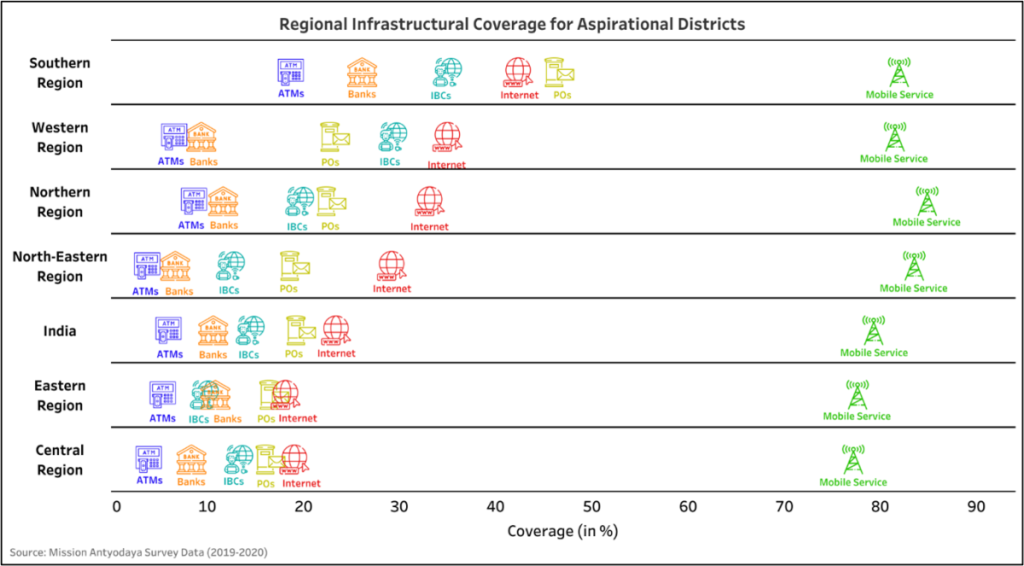

National coverage levels vary for each indicator. Firstly, the existing technological infrastructure for digital financial inclusion is promising for greater access to financial services digitally in the future. Among them, mobile service coverage is the highest (as shown in the figure below). In contrast, internet service coverage and IBCs need further development to match the coverage levels of mobile services. For access to financial services physically, the indicators reveal that postal presence is still considerably higher than the presence of banks across villages in these aspirational districts. Moreover, only some villages with a bank have access to ATM services.

Exhibit: Regional Infrastructural Coverage for Aspirational Districts of India

A regional overview of the infrastructural differences portrays an interestingly varied landscape. Firstly, aspirational districts in South India have the highest overall infrastructural capabilities for financial inclusion. The difference is highest in infrastructure for physical access to financial services due to the highest post-office, bank, and ATM coverage levels in South India. However, there is a sharp contrast in the infrastructure for physical FI and digital FI across aspirational districts in Northeast India. Despite having India’s lowest bank and ATM coverage levels, they have one of the highest mobile service coverages (falling short of only aspirational districts in the north). They also have higher than average levels of internet service coverage. Additionally, the central and eastern regions of the country require infrastructural improvements on all six fronts.

Analysis of Infrastructure for Digital and Physical Financial Inclusion

The indicators reveal that infrastructure for digital FI has a greater presence than physical FI across aspirational districts in India. However, the digital infrastructural superiority is driven by the high mobile service coverage compared to the other indicators. Thus, solutions for promoting digital FI based on existing capabilities should be explored for areas, especially North-East India, which currently has limited potential for physical FI. For instance, promoting mobile-based operations not reliant on internet connectivity, such as the USSD payments initiative, can be a positive step to improve digital FI. Within the physical FI domain, the postal coverage is higher than banks and ATMs. This presents an opportunity for fostering usage and awareness of postal financial services to improve physical FI in the short run. At the same time, the network of banks and ATMs expands across the country.

Assessing Financial Inclusion Infrastructure in Aspirational Districts of India

The study of infrastructural capabilities for financial inclusion in aspirational districts has revealed the disparities and opportunities that exist within the formal financial system in India. To achieve sustainable development goals and greater financial inclusion, policymakers must focus on addressing the gaps in physical and digital financial infrastructure. Based on our analysis, we recommend three policy conclusions. Firstly, there should be a concerted effort to improve digital financial infrastructure, particularly in areas with limited physical financial infrastructure. This can be achieved by promoting mobile-based operations that are not reliant on internet connectivity. Secondly, policymakers should prioritise the usage and awareness of postal financial services, which currently have higher coverage than banks and ATMs in many areas. Finally, there is a need for infrastructural improvements in the central and eastern regions of India on all six fronts to support greater financial inclusion. By adopting these policy recommendations, India can make significant progress towards achieving its financial inclusion goals, which are critical for sustainable development.

Author Bio: Tuneer Chakraborty is a postgraduate in Economics from the Toulouse School of Economics. He is currently working as a Research Associate (Financial Inclusion) at the Bharti Institute of Public Policy. Previously, he worked as a Research Assistant at the Fondation JJ Laffont in Toulouse to examine the efficacy of the EU single market.

Author Bio: Sanjeev Kumar Kaushal is a former banker and development finance practitioner and is currently leading Financial Inclusion knowledge vertical at the Bharti Institute of Public Policy.

DISCLAIMER : The views expressed in this blog/article are author’s personal.