Observed on May 11th every year, National Technology Day commemorates the successful Pokhran nuclear tests in 1998 and honours the achievements of the country’s scientists and engineers. However, over time, the day’s focus has shifted to recognising and celebrating the transformative role of technology in various aspects of our lives and how it can shape a better future. One such technology that has revolutionised the Indian payments sphere is the Unified Payments Interface (UPI).

Introduced in August 2016 by the National Payments Corporation of India (NPCI), UPI is built on the Immediate Payment Services (IMPS) infrastructure and is driven by India’s growing mobile phone and internet network. Through UPI, users can instantly transfer money to the recipient’s bank account using their phone number, UPI ID or a QR code. UPI has made going cashless easier than ever through increased user convenience and enhanced security by eliminating the requirement for bank details. This aligns perfectly with the Government of India’s goal of achieving a cashless economy for greater economic accountability and reducing the flow of counterfeit currency. Furthermore, going cashless promotes a greener financial alternative by reducing cash production and distribution cycle emissions.

The Growth of UPI in India’s Cashless Payment Ecosystem

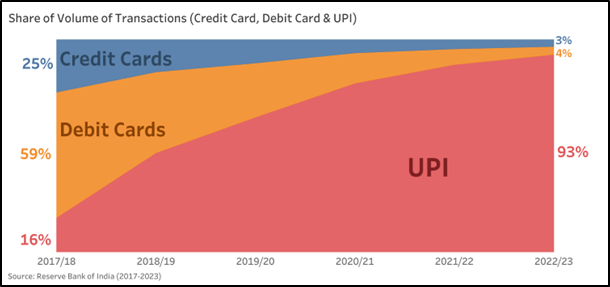

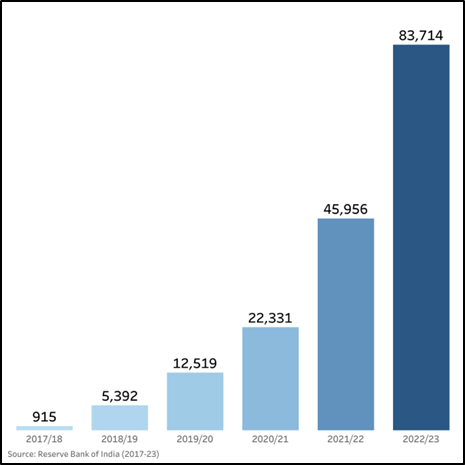

Since its launch in August 2016, UPI has rapidly grown in India’s cashless payment ecosystem. Among frequently used payment alternatives like credit cards, debit cards, and UPI, UPI’s share has grown from 16.16% in 2017-18 to a staggering 93% in 2022-23 (Figure 1). Interestingly, this increase in UPI usage has not just replaced other card alternatives but has also led to more cashless transactions overall. For instance, while total card transaction volumes increased from 4.78 billion to 6.3 billion from 2017-18 to 2022-23, UPI transaction volumes grew from 915.2 million to 83.7 billion over the same period. The growth in UPI transactions has been consistently upward, with some fiscal years witnessing significant spikes in volume growth. In 2018-19, UPI transactions crossed the one-billion mark for the first time and ended the year with more than five billion transactions. This transaction growth was immediately preceded by NPCI mandating the use of BharatQR in March 2018, which enabled interoperability across UPI apps. Additionally, during the COVID-19 pandemic, UPI transactions increased tremendously, nearly doubling compared to the previous fiscal year due to the surge in demand for contactless payment alternatives. Alongside the growth in UPI transactions, the number of UPI member banks has also increased, rising from 21 in April 2016 to 414 banks presently.

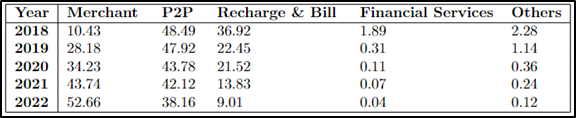

PhonePe is the market leader in UPI transactions, with 45.8% of UPI transactions in April 2023. In the form of PhonePe’s Pulse initiative, publicly available digital payment data present exciting trends within the cashless economy. In 2018, merchant payments only accounted for 10.43% of all transactions, but in 2022, they comprised the majority of digital transactions at 52.66%. With the growing prominence of UPI among digital payment alternatives, this increase in merchant payments indicates an increasing acceptance of UPI by merchants and customers alike.

Table 1: PhonePe Digital Payments Composition

Challenges to UPI Adoption across India

Despite the impressive growth of UPI in India’s cashless payment ecosystem, its adoption in rural areas still faces several challenges. This is a significant concern since about 65% of the Indian population resides in rural areas (according to a World Bank 2021 estimate). A survey conducted by 1Bridge in 100 villages across Karnataka, Maharashtra, and Telangana highlights concerning results about the state of UPI in these regions. The survey shows that only 3-7% of people in rural India actively use UPI, and approximately 40% of those surveyed had no idea about UPI or digital payments. This lack of awareness and trust in the digital system is a significant barrier to UPI adoption.

Moreover, the divide in internet usage across India further hampers UPI adoption, with active internet users in rural India being only half of those in urban areas, despite the rural population being twice that of urban India. Additionally, regional demarcation in UPI transaction usage poses a significant challenge. Despite smartphone penetration in the Northeast region being comparable to the national averages, UPI transaction volumes remain significantly low. Connectivity issues in the northeast region hamper UPI usage, including higher network downtimes (more than three times that in metropolitan areas) and 50% slower than the national average internet speeds. These challenges highlight the need for continued efforts to promote digital literacy and address infrastructure issues to accelerate UPI adoption in India further.

Expanding Capabilities and Services of UPI

UPI’s growing capabilities and services have been instrumental in expanding the digital finance landscape in India. The continuous improvement of UPI has allowed it to meet the various financial needs of individuals. Since UPI 2.0, several new products and features have been introduced to provide users with financial capabilities beyond basic transactions between deposit accounts. For instance, UPI Autopay allows for automatic payments of recurring bills and EMI, while UPI linkage with overdraft accounts enables users to pay later for amounts exceeding their bank balance. In April 2023, the Reserve Bank of India (RBI) approved pre-sanctioned credit lines through UPI, giving users more options to make payments using bank credit. Moreover, RuPay Credit cards can now be linked to UPI, enabling more credit-based operations. With the growing mobile and internet service penetration in India and the expanding capabilities of UPI, it has become possible to reach people across the country and provide them with access to financial services from anywhere digitally. UPI has also innovated inclusive digital finance options such as UPI 123PAY to facilitate transactions without an internet connection. Additionally, UPI’s expanding operational languages can help cater to diverse populations.

UPI has already reshaped consumer payment habits, as evidenced by the decline in cash transactions at the Point of Sale from 71% in 2019 to 27% in 2022. However, to achieve the goal of a cashless India and contribute to greater financial inclusion for all, it is crucial to focus on increasing UPI adoption by addressing the existing barriers to UPI. By doing so, UPI can help achieve the goal of a financial India while ensuring greater financial inclusion.

Addressing Barriers to UPI Usage and Adoption

To ensure UPI’s continued growth, addressing the barriers that hinder its usage and adoption is crucial. One of the most critical steps is increasing awareness of UPI and its security mechanisms among customers and merchants, particularly in rural India. By educating people about UPI’s services and allaying fears of losing money or falling prey to scams, the adoption of UPI can increase. Another critical issue is clearing misconceptions regarding Merchant Discount Rates (MDR) among merchants, which can help promote UPI merchant adoption. Following a government ruling in January 2020, merchants have been given MDR exemptions for UPI transactions allowing them to receive the total amount paid by the customer. It is crucial to invest in infrastructure to improve internet speed and minimise network downtimes, particularly in regions like northeast India, to support the growth of UPI transactions. Finally, promoting digital literacy can help bridge the urban-rural divide in internet usage and promote UPI usage. These policy recommendations are necessary to ensure that UPI continues to be a driving force in India’s digital economy.

About the authors

Tuneer Chakraborty is a postgraduate in Economics from the Toulouse School of Economics. He is currently working as a Research Associate (Financial Inclusion) at the Bharti Institute of Public Policy. Previously, he worked as a Research Assistant at the Fondation JJ Laffont in Toulouse to examine the efficacy of the EU single market.

Ritwick George is a graduate in Economics from Azim Premji University. He is currently working as an Intern (Financial Inclusion) at the Bharti Institute of Public Policy, Indian School of Business. He has previously worked at Sportz Interactive, Mumbai, and at the business editorial vertical at The Times of India, New Delhi.