As per UN reports, India, projected to be the most populous country in the world, faces the formidable challenge of ensuring complete Financial Inclusion. Improving access and active usage of formal financial services is critical in making them more convenient, affordable, and reliable. Unfortunately, large sections of the Indian population remain excluded, acting as an obstacle to achieving sustainable development goals. To address this, the Indian government has implemented various policy and regulatory interventions, including promoting financial literacy, microfinancing, differentiated banking, and innovative fintech products. In addition to this, India Stack has established a digital infrastructure enabling cost-efficient, robust, and user-friendly financial solutions.

In this article, we look at AePS, a service enabled through India Stack, a digital financial inclusion initiative launched by the National Payments Corporation of India (NPCI). By investigating the underlying transactions reported under AePS, we hope to understand the utilisation of various financial services by society’s unserved and underserved segments.

AePS: Leveraging Aadhaar’s Biometric Safeguards for Verification

AePS, as the name implies, is enabled by the underlying Aadhaar digital infrastructure. Aadhaar is the world’s most extensive national digital identification system, launched by the Unique Identification Authority of India (UIDAI) in 2009. More than 1.3 billion Aadhaar numbers have been issued until 2022. Under Aadhaar, all applicant residents are assigned a unique 12-digit identification number to which the demographic and biometric data of the applicant is linked. The biometric information linked with Aadhaar enables UIDAI to detect and remove duplicate Aadhaar numbers from their database. The widescale adoption and the biometric safeguard mechanism of Aadhaar make it a powerful instrument for digitally establishing users’ identities. Thus, making the customer verification process for financial services faster, more reliable, and cost-effective.

Aadhaar Enabled Bank Accounts (AEBA): The Gateway to AePS

In addition to an Aadhaar number, customers must have a bank account to use AePS. Government financial inclusion initiatives, such as the Pradhan Mantri Jan Dhan Yojana (PMJDY), have immensely improved the proportion of people with a bank account in India. The opening of more than 46 crore new bank accounts since the launch of PMJDY in 2014 attests to the programme’s success. Furthermore, AePS requires that the account be connected (or seeded) with the Aadhaar number to prove bank account ownership. The bank accounts seeded with Aadhaar are termed Aadhaar Enabled Bank Accounts (AEBA). Customers can access the various financial services offered by AePS using an AEBA and their Aadhaar number as their proof of identity.

Enabling Financial Inclusion through Interoperability

AePS is a bank-led model that enables interoperable financial transactions at Point-of-Sale machines (Micro ATMs) through any bank-approved Business correspondent (BC). Users of AePS need to provide their Bank name and Aadhaar number and be physically present for biometric authentication by the BC. Using AePS, customers can access essential digital financial services such as transferring funds (inter and intra-bank), BHIM Aadhaar Pay (customer-to-merchant online payments), balance enquiry, and services such as cash withdrawals and deposits. The BC model of AePS enables the use of financial services by people in remote locations and those lacking the technical knowledge to use these services digitally. Thus, AePS provides a way to enhance financial inclusion by overcoming the existing infrastructural and technical barriers.

Transactions using AePS

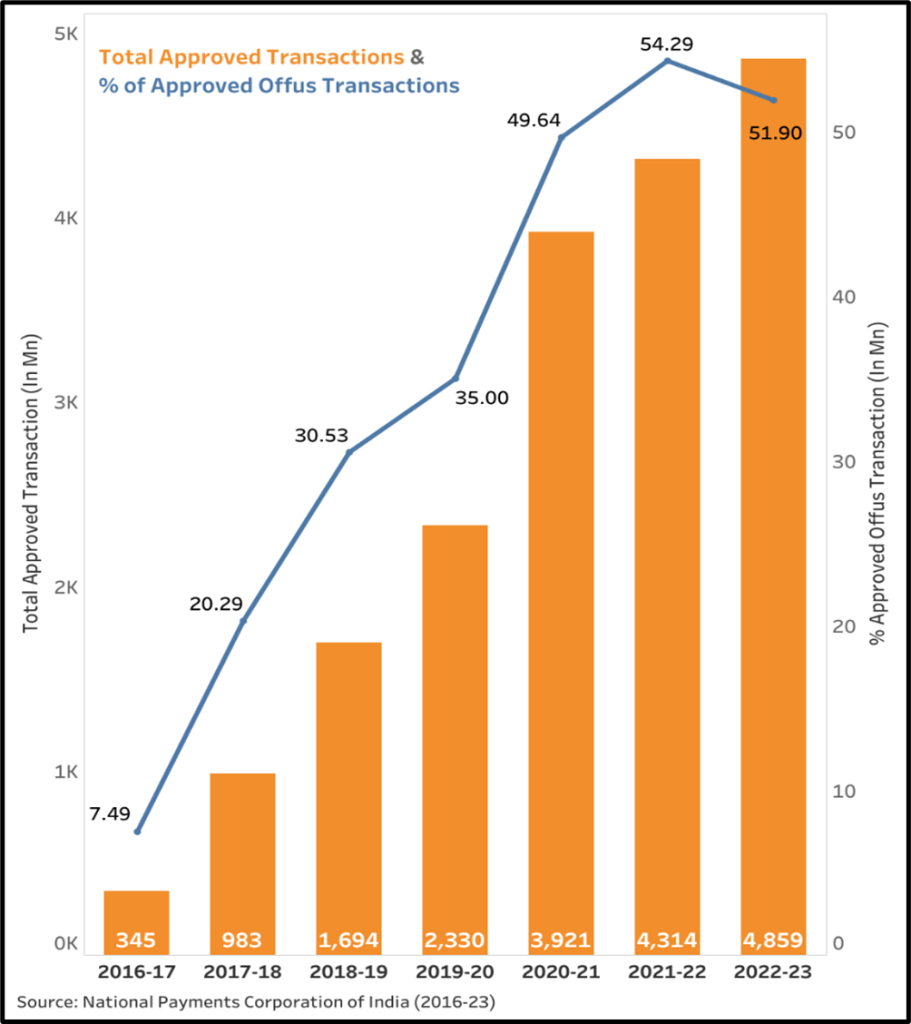

Transactions using AePS have witnessed remarkable growth since its launch in 2016, as shown in the figure below. AePS transaction volume in the last fiscal year (2022-23) stood at 4.86 billion compared to 345 million in 2016-17. Notably, in 2020-21, AePS transaction volume witnessed a sharp spike, increasing by approximately 1.6 billion in a single year. Interestingly, the increase in demand for AePS coincided with the Covid-19 pandemic, during which people were severely restricted in their mobility. Thus, demonstrating the role AePS can play in times of adversity.

Figure 1: AePS Transaction Volumes & % Off-us Transactions

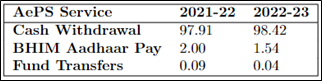

The NPCI released a breakdown of three AePS financial transaction services for the fiscal years 2021-22 and 2022-23 (Table 1). The statistics demonstrate that cash withdrawals using AePS accounted for 97.9% of the three AePS transactions in 2021-22, which grew to 98.4% in 2022-23. The joint share of the two remaining AePS transaction services, BHIM Aadhaar Pay and Bank-to-Bank fund transfers declined from 2.1% to 1.6% over these two years. Therefore, despite the digital financial services provided by AePS, there is high cash dependence among AePS users. This indicates the need to understand the challenges facing AePS digital services usage to further the goal of a cashless India.

Table 1: AePS Transaction Breakdown (in %)

Source: NPCI Monthly Product Statistics (April 2021- March 2023)

Challenges facing AePS

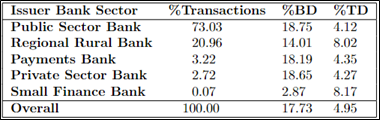

In addition to the appropriate infrastructure and technical knowledge, transitioning from cash-based transactions to digital transactions demands confidence in the reliability of digital alternatives. Instances of failed digital transactions erode user trust and serve as setbacks in the switch from cash to digital payment alternatives. These transaction failures can be of two types, Business Decline (BD) and Technical Decline (TD). BD are user-centric transaction declines such as incorrect pin entry, insufficient balance, or transactions beyond stipulated limits. In comparison, TD occurs due to technical shortcomings with bank or NPCI systems, such as network connectivity issues and server downtime. Customers using AePS face a BD rate of 17.73% and a TD rate of 4.95% on average. The figures suggest that more than 1 out of 5 transactions initiated using AePS are declined. Around 94% of all AePS transactions are associated with account holders of public sector banks (~73%) or regional rural banks (~21%). However, public sector banks (PSBs) have the highest BD of 18.75%, while regional rural banks have one of the highest TD of 8.02% (marginally better than small finance banks). The high decline rates indicate a reliability issue with AePS transactions, possibly hindering the usage of cashless AePS services.

Table 2: Sectoral BD & TD

Source: NPCI BD TD (Aug 2021- July 2022)

Moreover, the percentage of inter-bank transactions (as shown in Table 2) (also known as off-us transactions) has risen from 7.49% in 2016-17 to 51.9% in 2022-23 (Figure 1). This means that most AePS transactions are processed through Micro ATMs connected to banks (acquirer banks) other than the customer’s (issuer bank). The issuer bank must pay the acquirer bank an interchange fee for off-us AePS transactions. Because they are the issuing banks for the majority of AePS transactions, PSBs bear a hefty interchange fee burden. Finding solutions to lower the interchange fee burden for PSBs would allow them to use their funds more efficiently to promote digital financial inclusion.

Realizing the Potential of AePS for Digital Financial Inclusion in India

AePS has emerged as a game-changer in India’s financial inclusion journey, promoting the active use of formal financial services through improved accessibility and simplicity. However, the system’s potential to enable digital payments must be tapped beyond cash withdrawals.

Firstly, there should be a concerted effort to increase the reliability of AePS digital transactions by decreasing BD and TD levels. Raising awareness through financial literacy among AePS users can help reduce BD, while TD levels can be minimised by adequate infrastructural investments by banks to eliminate technical shortcomings.

Secondly, as the issuer bank for most AePS transactions, PSBs should strive to promote using Micro ATMs connected to issuer banks to lower interchange fees. This could be achieved by expanding the reach of PSB-affiliated Micro ATMs and incentivising BCs to conduct on-us (intrabank) transactions. The savings generated should be reinvested to promote digital financial inclusion.

Finally, encouraging account balance maintenance and fostering a digital payment environment for day-to-day purchases could go a long way in promoting cashless transactions. By adopting such measures, AePS can realise its potential and contribute to the vision of a cashless India.

Tuneer Chakraborty is a postgraduate in Economics from the Toulouse School of Economics. He is currently working as a Research Associate (Financial Inclusion) at the Bharti Institute of Public Policy. Previously, he worked as a Research Assistant at the Fondation JJ Laffont in Toulouse to examine the efficacy of the EU single market.

Ritwick George is a graduate in Economics from Azim Premji University. He is currently working as an Intern (Financial Inclusion) at the Bharti Institute of Public Policy, Indian School of Business. He has previously worked at Sportz Interactive, Mumbai, and at the business editorial vertical at The Times of India, New Delhi.

Sanjeev Kumar Kaushal is a former banker and development finance practitioner and is currently leading Financial Inclusion knowledge vertical at the Bharti Institute of Public Policy.