Introduction: Echoes of Past Economic Shocks

The announcement of the reciprocal tariffs on its trading partners by the American President on 2nd April 2025 is undoubtedly one of the most historic economic decisions taken by the USA, for better or worse. However, only a few weeks later, the world witnessed a pause on most of the tariffs, followed by a severe trade war with China, followed by an unexpected trade agreement between the two most powerful economies today. Given the indisputable ambiguity surrounding the trade policy’s immediate and long-term effects on the world economy, we are compelled to go back to periods when American policies have had a significant impact on global affairs. The Federal Reserve’s Tapering Policy in May 2013 is likely the closest example one could come up with, but the scope and mode of impact of a monetary policy decision in the United States would differ greatly from the effects of a trade policy decision by the largest developed economy in the world.

The 2013 Taper Tantrum: A Precedent for Global Financial Shifts

On May 22nd 2013, the then Chairman of the Fed, Dr. Ben Bernanke, pointed out the possibility of tapering the security purchases by the Fed, in his testimony to the US Congress. The tapering period continued till at least April 2015, and this period saw a major shift in global financial flows and subsequently, asset prices globally. It has been shown that those emerging economies that had the most ‘deteriorated’ environments saw the worst vulnerability in asset prices. Also, the response to the Fed’s tapering talks was not uniform across emerging markets. These volatilities and fluctuations in a set of five countries (Brazil, India, South Africa, Turkey, Indonesia) caused Morgan Stanley to coin the term ‘Fragile Five’ since they were the worst affected economies.

A few years later, S&P made a different ‘Fragile Five’ list based on the vulnerability to interest rate changes, and this included – Turkey, Argentina, Pakistan, Egypt, and Qatar.

Beyond Monetary Policy: Geopolitical Events and Their Economic Ripple Effects

While the tapering policy caused economic shifts due to the decision of a Central bank, some recent events have also immensely impacted global financial markets such as the COVID-19 pandemic, which brought multiple national economies close to a standstill, and severely impacted economic growth as well as financial markets everywhere. The COVID-19 pandemic caused a tightening of the liquidity structure of the forex and security markets worldwide, while also triggering extraordinary volatility. Post the pandemic, the world has witnessed two major armed aggressions, the Russia-Ukraine conflict and the Israel-Hamas-Iran conflict, both of which have disrupted global supply chains, financial movements, and the energy sector at large.

The latest decision, albeit a trade policy decision, is another one which has already started showing its impact on global markets, even more so with the announcement of retaliatory tariffs by China and others.

For all the countries that have ever appeared in a fragility list, this is a crucial juncture. While some of those countries have worked tremendously hard to stabilise their financial institutions and strengthen global integration while maintaining the capability to respond in times of crisis, it is interesting to evaluate exactly how immune these countries in the so-called ‘Dollar zone of influence’ are to USA’s Economic Policy Uncertainty.

The Exchange Market Mechanism: A Lens for Evaluating Impact

While there can be many measures of impact on an economy due to policy uncertainty in another economy, this writeup focusses on the Exchange-Market mechanism. It is the exchange rate of a country, that on a relatively high frequency, allows us to evaluate the impact a country faces due to geopolitical activity/policy (positive as well as negative), and it also allows us to explain the impact on several other aspects of an economy, including Balance of Payments, Stock Market movements etc. One past study took a rather novel approach to analyse market and exchange rates, using copulas. It tried to understand the co-movement between monetary policy in the US and the Exchange rate and stock price movements in Emerging Economies. It shows that the co-dependencies in the mentioned variables are reducing over time, and the co-movement of exchange rates with US monetary policy is almost nullified between 2013 and 2017.

A study from 2017 built upon past approaches to calculate Exchange Market Pressure (EMP). EMP indices were first constructed to aid the analysis of currency crises but suffered the inability to compare cross-country EMPs. They have constructed a method to calculate an EMP index that allows cross-country comparison over time. Using these Exchange Market Pressure index values (on a monthly basis), and Economic Policy Uncertainty in the USA (sourced from the Federal Reserve Bank of St. Louis), we employ Wavelet Coherency Analysis to see which of the so-called ‘Fragile’ economies might continue to be vulnerable, especially in these testing times. Our choice of wavelet coherency analysis is because it shows how strong the co-movement between two variables is, across the chosen time frame for various frequencies or periodicities (i.e. from the short run to the long run). The value of wavelet coherency falls within the [0,1] range. In the wavelet ‘cone of influence’ (where the data is sufficient to make significant comments), the closer the value to 1, the stronger the co-movement.

Country-Specific Vulnerabilities: A Detailed Examination of Nine Economies

This writeup explores nine distinct countries as mentioned in Table I, in the ‘Fragile Five’ or the ‘New Fragile Five’ list (Turkey is the only nation that finds a place in both lists).

Table I: List of countries for analysis

| Argentina | Brazil | India | Indonesia |

| Turkey | Egypt | Qatar | Pakistan |

| South Africa |

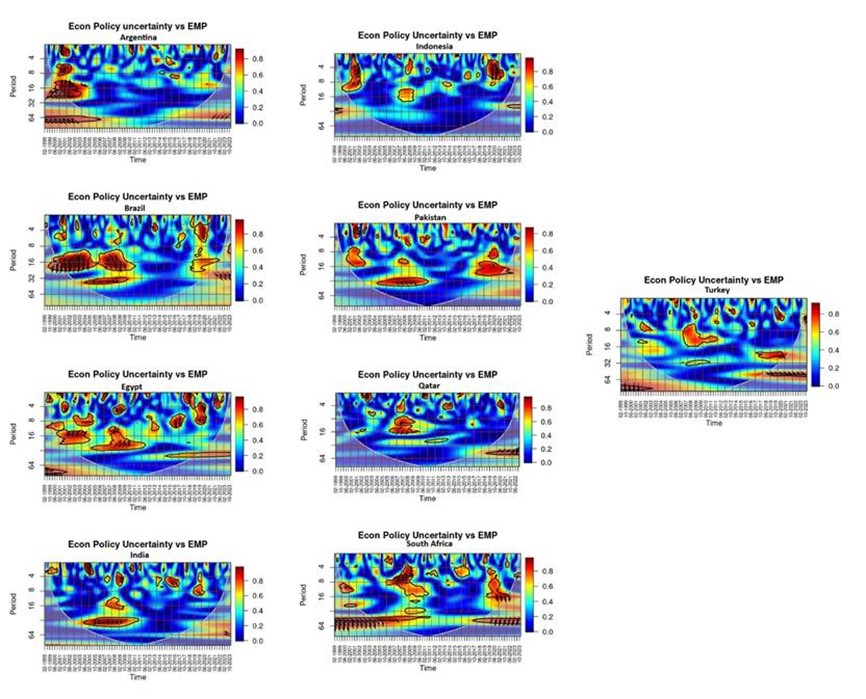

The results are presented in Figure 1 below:

Source: Provided by authors

Figure 1 shows the trends of the nine economies through Wavelet-Coherency Plots. Argentina was facing considerable trouble in the short-term and long-term issues due to the USA’s Economic Policy Uncertainty (EPU) prior to 2004-05. However, since then, it has built tremendous immunity against the USA’s EPU, almost escaping the Global Financial Crisis, the Taper Tantrums, and even the COVID-19 pandemic, barring a few short-term episodes of fragility.

Brazil shows medium to long-term fragility right from the early 2000s to the end of the global financial crisis. Again, during and after the COVID-19 pandemic, it suffered from fragility due to the USA’s EPU, albeit short-term. This is followed by Egypt, which shows trends of multiple episodes of fragility of varying duration and impact. In both the short as well as long-term, Egypt has almost constantly seen impacts due to the USA’s EPU, with there seldom being any long period when Egypt’s Exchange market has been immune.

India also seemed to be affected tremendously by USA’s EPU in the long term, especially till mid-2010, and although the impact since then has been reduced to short-term episodes of fragility, the Exchange Market Pressure has largely withstood crises like the COVID-19 pandemic and Russia-Ukraine war and the Middle Eastern conflict from 2023 without much trouble. This is in clear contrast to Indonesia, which shows us strong episodes of short and long-term fragility in the early 2000s, followed by mild fragility during the GFC. However, it had performed tremendously well compared to its peers between 2009 and 2020, when the pandemic struck.

Pakistan has suffered from both prolonged phases of long-term vulnerability, as well as multiple episodes of short-term fragility due to the USA’s EPU. This is a big cause of concern because in the decades under study, barring a small phase between 2011 and 2016, Pakistan has not been able to show resilience to policy uncertainty in the USA.

Qatar is an economy which shows only one period of long-term fragility in the recent past, the GFC. By and large, the exchange market pressure has shown tranquility except for a few occasional instances of short-term strong co-movements. This is in stark contrast to South Africa, which can easily be classified among the top three worst performers in terms of fragility (along with Egypt and Pakistan). It has shown many episodes of prolonged long-term fragility, and the worrying trend is that the co-movements aren’t subsiding (and instead, evidence seems to suggest further worsening of the Exchange Market Pressure in the future).

Despite appearing on both fragility lists, Turkey has performed relatively better than several of its peers in managing the effects of U.S. Economic Policy Uncertainty. While the Global Financial Crisis marked a period of significant co-movements, a more pressing concern is Turkey’s slide into long-term fragility during the COVID-19 pandemic, with persistent signs of vulnerability in recent years. It is also important to consider Turkey’s geographic proximity to multiple conflict zones-including the Middle East and the Russia-Ukraine region-which may have exposed the country to additional external shocks beyond U.S. policy uncertainty.

Resilience and Recurring Fragility: Key Takeaways from the Analysis

The wavelet coherency analysis of the nine economies offers important information on the different levels of short- and long-term vulnerability to U.S. Economic Policy Uncertainty (EPU). With minimal long-term effects on their exchange market pressure, nations like Argentina, India, and Qatar have made significant strides in enhancing their resilience after surviving major world shocks like the COVID-19 pandemic, the Taper Tantrums, and the Global Financial Crisis (GFC). On the other hand, economies such as Egypt, South Africa, and Pakistan exhibit recurring episodes of long-term fragility, which is indicative of structural deficiencies and increased susceptibility to external shocks.

In Conclusion: Policy Implications for a Resilient Global Economy

From a policy standpoint, these findings emphasise the critical need for developing economies to enhance macroeconomic buffers and reduce external dependency. Economies with frequent episodes of long-term co-movement with the U.S. EPU, such as Pakistan and South Africa, must focus on improving policy predictability, strengthening institutional frameworks, and diversifying economic partnerships to mitigate external contagion effects. For relatively resilient economies like India and Indonesia, continued efforts in managing external balances and maintaining investor confidence will be key to sustaining this resilience. Meanwhile, countries like Turkey-facing growing pressures due to geopolitical proximity to conflict zones-must balance domestic stability with robust diplomatic and financial strategies to contain spillovers from external uncertainties.

Furthermore, a system for regional cooperation or coordinated fiscal and monetary policies among nations that are similarly vulnerable could lessen the impact of upcoming global uncertainty. Governments can stop short-term shocks from turning into long-term crises by keeping a close eye on changes in international policy and acting promptly at home.

Authors’ Bios’:

Srijan Shashwat is a dual-degree Computer Science and Economics student at the Birla Institute of Technology and Science, Pilani – Pilani Campus. He has published in international peer-reviewed journals in the past and has research interest in Financial and Environmental Economics. He worked as a Summer Fellow at IIT Madras, and in Data Science roles at Atlassian and JPMorgan Chase.

Dr. Arun Kumar Giri is a Professor in the Department of Economics and Finance at BITS Pilani, Pilani Campus, and has served as the Head of the Department. He holds a PhD in Economics from the University of Hyderabad. His research interests include Financial Economics, Macroeconomics and Environmental Economics. In a career spanning more than 26 years, he has authored over 120 Scopus Indexed publications in national and international journals and currently serves on the Editorial Board of Heliyon (Elsevier) and is a Guest Editor of Discover Sustainability (Springer).