Introduction

Since the introduction of the Electricity Act of 2003, wherein trading was identified as a separate licensed activity, the Indian power sector has been liberalising and transforming. Over the last two decades, we have seen multiple policy interventions for developing a vibrant market structure, capturing the requirements and dynamics of the market from time to time. Before 2000, power was allocated to the beneficiaries (erstwhile State Electricity Boards (SEB)) based upon the allocation from plants as decided by the Central Electricity Authority (CEA) or Ministry of Power (MoP). In contrast, today the SEBs have been unbundled, and the respective Distribution Companies (Discom) are making decisions on their power requirement from the available options in prevailing market.

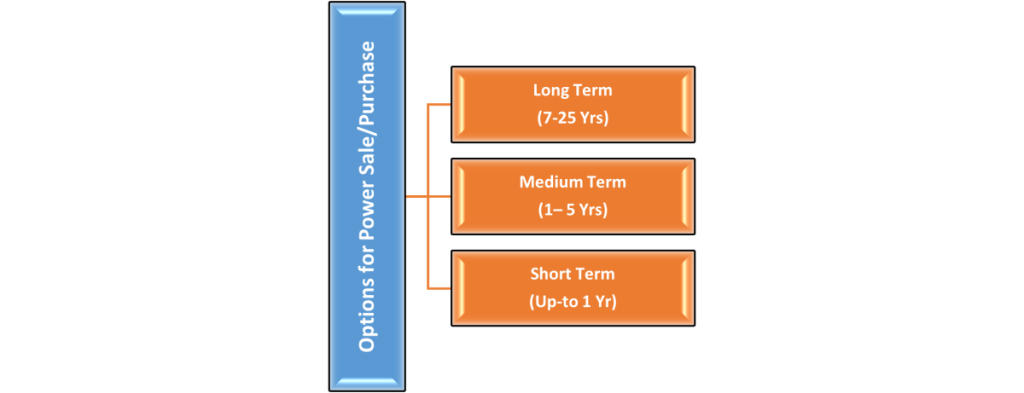

In the present market, the options available for a Discom or a Generator include the purchase/ sale of power from 15 minutes ahead to more than 7 years. These options are broadly divided into three different categories, as depicted in Fig 1 below:

(Source: Adapted from relevant Act and Regulations issued by MoP & CERC)

Short Term Electricity Market in India

Based upon the power requirement of a Discom or surplus power availability of a generator, the power can be sold/ purchased amongst the above products. However, with growing economic activities, the demand pattern of every state(s) has also been transforming, pushing the policymakers to introduce new products into the system. Accordingly, in 2008, we witnessed the introduction of power exchange(s) in India, taking the power market to a new dimension under the short-term vertical. Various new products have been gradually introduced in the PXs, but the most successful product was the Day Ahead Market (DAM), which allows the participant to buy/ sell power for the next day.

After a successful stint of more than a decade by DAM product in power exchange, we finally saw the introduction of newer products like Real-time market (RTM), which further provided the participant with an option to buy/ sell power almost an hour ahead. With better demand forecasting and certainty of power availability, this product has acted as a boom for the market. Further, with the onset of more emphasis on renewable energy development, the requirement of a product catering only to renewable energy started getting created. The policymakers again responded to this requirement by introducing the Green Day-ahead and Green Term-Ahead market wherein only renewable energy suppliers were permitted to participate as sellers. Buyers (Discoms or industrial/ commercial customers) based upon their requirements can now participate in these market segments to purchase green power for fulfilment of their respective green/ renewable goals.

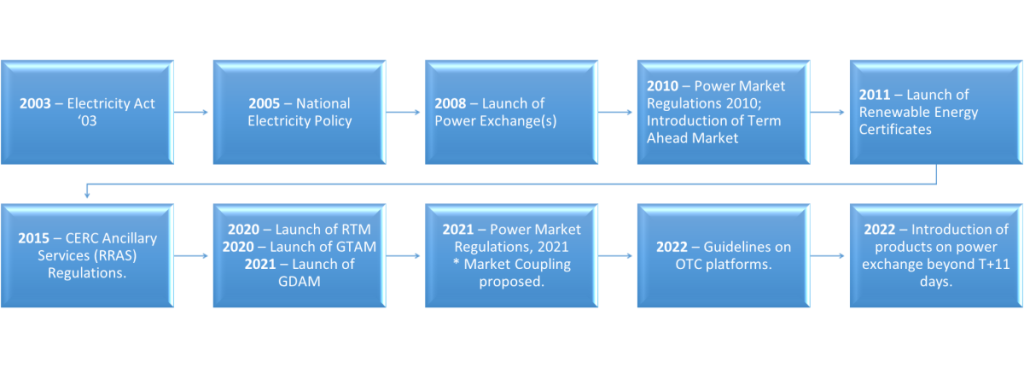

So far, we can see that the market has been responding to the changing market behaviour, providing newer policy interventions and products to cater to the participants’ requirements. The same can be observed from the figure below:

(Source: Compiled from relevant Act and Regulations issued by MoP & CERC)

Engagement with Neighbouring Countries

Apart from the development of the power market within India, our engagement has also grown with the neighbouring countries for cross-border power trade. One of the earliest trades started with Bhutan in 2003 (import of power to India), followed by Nepal in 2007 (import and export to India based upon season) and subsequently with Bangladesh in 2012 (export from India). With their evolving requirements, the engagement with each of these countries has also grown and evolved. Today, based on the season (dry or wet), India undertakes both import and export of power to Bhutan and Nepal and continues to supply power to Bangladesh.

Way Forward

The Indian power market requires more products/ services that can push more participation in the Short-Term segment where the trades based upon demand-supply occur. This may also mean introducing financial derivatives, which will provide an alternate market segment and generate a price index that could define future trades. Another important aspect to be noted includes the presence of multiple power exchange(s) in India, which creates a splitting of market liquidity. For such market structure, introduction of Market Coupling would help in unifying the market volume for power exchange(s) and provide a better signal to the market with transparent price discovery.

Indian power market today is at the cusp of a transition to a market structure with deeper trades in term short-term segments, which provides for more reflective market sentiments. To facilitate this transition, some of the potential policy measures include:

Concept of Aggregator: Introduction of favourable policies that encourage wider participation from multiple energy sources, bulk consumers and energy storage system, demand response, etc. One such provision is the introduction of the concept of aggregator wherein multiple buying and selling entities can be consolidated by a single entity which participates in market with a collective volume. Larger participation would not only promote competition, more liquidity and reflective price discovery, but also encourage more investments and innovation in the sector. (eg: recent Electricity (Amendment) Rules, 2024 encourage participation from energy storage systems).

Transmission system up-gradation: Investment in grid infrastructure is another area which requires due consideration from the policymakers. The evacuation of the growing renewable capacity along with increasing electricity demand with massive economic activity, would both require upgradation and enhancement of the grid infrastructure. This would enable in better handling of the variability and intermittency of large renewables in the grid system. Additionally, we also require adoption and integration of new and advanced technologies like battery energy storage system, smart grids, etc.

Market Coupling: Considering the present structure of Indian power market with the presence of multiple power exchange, it is important that policy makers introduce market coupling for enhancing the efficiency and integration of all exchanges in India. Coupling essentially unifies the bids from all three exchanges and provides a single price for market. Unified price will also help in providing a price index for the market which could further help in settlement of financial derivatives. By integrating the exchange markets, it optimises the allocation of electricity and transmission capacity, ensuring that power is generated where it’s most cost-effective and delivered where it’s needed most. This mechanism promotes price convergence, reducing arbitrage opportunities and leading to more stable prices. The Indian power market in its present form can be summarised as a vibrant market with multiple options catering to the requirements of market participants across the domain. Still, it needs to evolve by offering new products/ services to market participants, encouraging more participation, deepening of the market and more reflective price discovery.

Author’s Bio: Anupum Vadehra is a student of the Advanced Management Progamme in Public Policy (AMPPP) at Bharti Institute of Public Policy, Indian School of Business. He is the Assistant Vice President of Business Development and Marketing at PTC India Ltd. (formerly Power Trading Corporation of India Limited), bringing around 15 years of experience in the energy sector. He is adept in strategy planning, networking, policy advocacy, portfolio management, and advisory services. He has a strong track record in developing strategic relationships with utilities, government authorities, development banks, and international stakeholders which helps him innovate and implement effective business development initiatives on a global scale.

DISCLAIMER : The views expressed in this blog/article are author’s personal.